BTC Price Prediction: Key Indicators and Market Sentiment Point to Upside Potential

#BTC

- Technical Strength: MACD bullish crossover and Bollinger Band support suggest upward momentum.

- Institutional Demand: Major investments by firms like Metaplanet and Capital B signal confidence.

- Macro Catalysts: Regulatory developments (e.g., SEC ETFs) and mining innovations could drive prices higher.

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Trends

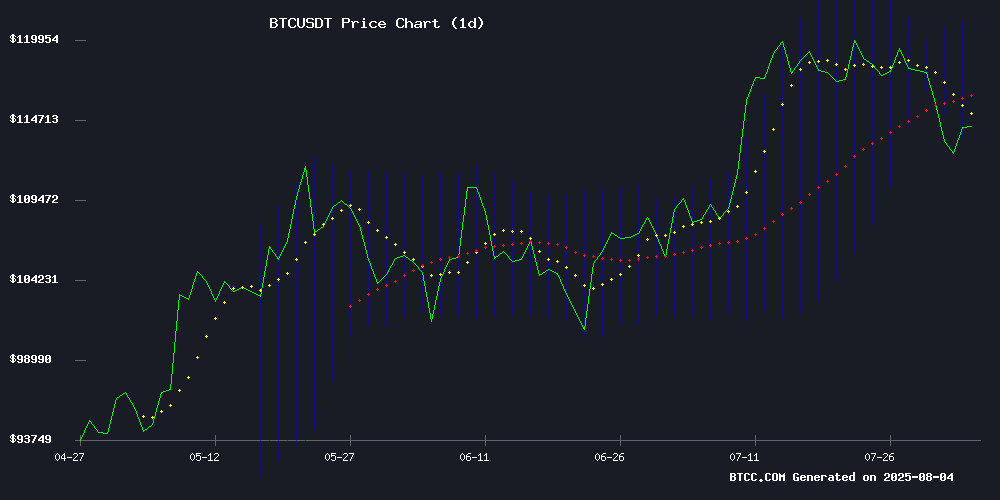

According to BTCC financial analyst William, Bitcoin (BTC) is currently trading at 114,664.84 USDT, slightly below its 20-day moving average (MA) of 117,227.747. The MACD indicator shows a bullish crossover with the MACD line at 1,246.5522, above the signal line at -390.9057, and a positive histogram at 1,637.4579. Bollinger Bands indicate the price is near the lower band at 113,231.3051, suggesting potential support. William notes that while BTC is below the MA, the MACD signals upward momentum, and a rebound from the lower Bollinger Band could indicate a buying opportunity.

Market Sentiment: Bullish Catalysts for Bitcoin

BTCC financial analyst William highlights several bullish factors for Bitcoin. Eric Trump's call to buy the dip and institutional investments like Capital B and TOBAM's €11.5 million BTC purchase reflect growing confidence. Analysts predict a rally to $140K before 2026, while Metaplanet's $53.7M bitcoin bet and France's exploration of nuclear-powered mining underscore long-term optimism. However, SEC ETF-related volatility and the Satoshi statue incident may cause short-term fluctuations. William emphasizes that these developments align with technical indicators, reinforcing a bullish outlook.

Factors Influencing BTC’s Price

Eric Trump Urges Bitcoin Dip Buying as BTC Tests Key Support Levels

Bitcoin's price dipped 3.76% below the $117,000-$120,000 range, prompting Eric Trump to publicly advocate buying the downturn. His social media call to action coincided with BTC testing critical support levels after an 8% retracement from July's $123,000 all-time high.

Historical data reveals August's seasonal weakness for Bitcoin, with negative returns in 60% of the past twelve years. However, post-halving years (2013, 2017, 2021) bucked the trend with double-digit gains, offering bulls a potential precedent.

Analysts highlight $100,000 as the crucial support threshold for maintaining Bitcoin's uptrend. Institutional sentiment appears cautious, with BTC ETFs recording $800 million in quarterly outflows - their worst performance on record.

Bitcoin Poised for $140K Rally Before 2026 Bear Market, Elliott Wave Analyst Predicts

Bitcoin remains on track to reach $140,000 by year-end despite a recent 4% pullback, according to Elliott Wave theorist John Glover of Ledn. The cryptocurrency briefly dipped below $112,000 over the weekend amid profit-taking by long-term holders near the $120,000 level.

"This retracement represents a typical breather within a larger bullish impulse wave," Glover noted, maintaining his $135,000-$140,000 price target for late 2025. The analyst anticipates completion of a five-wave pattern before entering a projected bear market in 2026.

The sell-off coincided with declines in crypto equities like MicroStrategy and Coinbase. Market technicians view the Elliott Wave Theory—developed by Ralph Nelson Elliott in 1938—as a framework for identifying recurring fractal patterns in financial markets.

SEC’s Bitcoin ETF Decision Spurs Market Volatility Debate

The U.S. Securities and Exchange Commission’s expansion of options position limits for Bitcoin ETFs has ignited discussions about potential market volatility. Institutional investors can now hold ten times more contracts, enabling large-scale covered call strategies that may cap upside price movements.

Bitcoin’s volatility has declined sharply since 2020, with the Deribit BTC Volatility Index dropping from 90 to 38. Yet it remains significantly more volatile than traditional assets. "Covered call strategies perform optimally on a large scale," notes NYDIG Research, suggesting the new rules could dampen price swings while generating yield.

Capital B and TOBAM Expand Bitcoin Holdings with €11.5 Million Investment

Capital B has partnered with the TOBAM Bitcoin Alpha Fund to secure €11.5 million, earmarked for the purchase of an additional 160 BTC. This acquisition will elevate Capital B's total Bitcoin reserves to 2,173 BTC, underscoring a strategic push into the digital asset arena.

The collaboration reflects deepening institutional interest in cryptocurrency as both firms aim to solidify their positions in a rapidly evolving market. Bitcoin remains the focal point of this expansion, signaling confidence in its long-term value proposition.

Metaplanet's Bold $53.7M Bitcoin Bet Defies Market Slump

Metaplanet, a Tokyo-based technology firm, has made a strategic leap into digital assets with a $53.7 million Bitcoin purchase. The company acquired 463 BTC at an average price of $115,895 per coin, signaling institutional confidence amid cryptocurrency volatility.

The move comes as Bitcoin shows tentative signs of recovery following recent market declines. Analysts suggest such large-scale acquisitions could provide psychological support for battered crypto markets. "This isn't just diversification—it's a calculated endorsement of Bitcoin's long-term value proposition," noted one market observer.

Metaplanet's management framed the investment as part of a broader portfolio strategy, citing growing global institutional interest in cryptocurrency assets. The purchase positions the firm alongside other corporate Bitcoin holders like MicroStrategy, though at a notably lower entry point than some previous institutional buyers.

Strategy Surpasses Financial Giants with Bitcoin-Driven Record Earnings

Strategy, formerly known as MicroStrategy, reported a staggering net income of $10.02 billion for Q2 2025, eclipsing Goldman Sachs' $3.7 billion and Bank of America's $6.8 billion. The windfall was fueled by its aggressive Bitcoin investments, with the company holding 628,791 BTC at a total cost of $46.07 billion—yielding a 25% return year-to-date.

CEO Michael Saylor's bet on Bitcoin continues to pay off, with the firm targeting a 30% annual return on its crypto holdings. To fund further expansion, Strategy plans to issue $4.2 billion in new shares. "Strategy's income this quarter is nearly triple that of Goldman Sachs," observed Bitwise CIO Matt Hougan.

Meanwhile, Japanese firm Metaplanet is making similar strategic moves into Bitcoin, signaling growing institutional confidence in cryptocurrency as a core asset class.

France Explores Nuclear-Powered Bitcoin Mining in Policy Reversal

France's far-right National Rally party is drafting legislation to repurpose surplus nuclear energy for Bitcoin mining. The five-year pilot program, proposed by MP Aurélien Lopez-Liguori, would utilize excess capacity at facilities like the Flamanville plant during low-demand periods.

The initiative marks a stark reversal for party leader Marine Le Pen, who advocated a blanket crypto ban in 2016. By 2022, her position evolved toward regulation. The current proposal positions Bitcoin mining as a fiscal solution - converting wasted energy into an estimated $100-150 million annual revenue stream per gigawatt deployed.

Industry analysts note the scheme could stabilize France's power grid. Mining operations would act as flexible load resources, absorbing surplus production that currently depresses electricity prices. The technical feasibility study coincides with growing European interest in energy-intensive blockchain applications.

Satoshi Statue Stolen, Later Found Damaged in Lugano

A bronze statue commemorating Bitcoin's pseudonymous creator, Satoshi Nakamoto, was stolen from a public square in Lugano, Switzerland, before being recovered in a damaged state near the city's waterfront. The incident has sparked discussions about Bitcoin's cultural symbolism and the motives behind the vandalism.

Local art collective SatoshiGallery offered a 0.1 BTC bounty for information leading to the statue's recovery. While the perpetrator remains unidentified, the theft highlights growing mainstream recognition of cryptocurrency iconography. The damaged statue now serves as an unintended metaphor for Bitcoin's resilience—battered but not destroyed.

Is BTC a good investment?

Based on technical and fundamental analysis, Bitcoin (BTC) appears to be a compelling investment. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | 114,664.84 USDT |

| 20-Day MA | 117,227.747 |

| MACD (Bullish) | 1,246.5522 |

| Bollinger Bands Support | 113,231.3051 |

William notes that institutional interest, positive technical signals, and macroeconomic catalysts like ETF approvals and mining innovations support BTC's long-term growth. However, investors should monitor short-term volatility.